The price of Gamestop stock reached record highs this week, driven largely by retail investors and Reddit chatter. You’ve probably heard about that. Those hoping for a quick, hefty payout might have some trouble getting rich. But it’s been another story for long-time Gamestop investors like Jeff Feldman who bought stock way back in 2002. He sat down (texted) with BNet’s reporter (me, his brother) for this exclusive interview.

When did you buy Gamestop stock and why?

After my bar mitzvah in 2002, dad suggested we invest some of my gift money into a stock of my choice. Basically just so I could learn about how the stock market works. I immediately wanted to invest in Nintendo, but dad didn’t want to mess with the yen, and I’m not sure you could even buy Nintendo at that point anyway. I didn’t really have any other ideas. But we were constantly going to the strip mall in East Brunswick to check if Borders had the latest Animorphs book yet, and while we were there we would go browse in Gamestop or Funcoland, since inexplicably they were both in that same strip mall with a Best Buy between them. And so shortly after that we were in Gamestop and dad was like “You know, this store is always crowded.” So we bought some shares in March 2002.

Over the last 19 years, were you ever tempted to sell those shares? Did you follow Gamestop’s trajectory closely?

Dad definitely followed it more closely than I did. He would text me every once in a while to say it was up or it was down. I don’t really remember if I ever checked on it much before college, but I remember thinking it wasn’t a terrible pick. I got my first smartphone in maybe 2009, junior year of college, and I remember putting GME into a stocks app and looking at it every once in a while. But I don’t think I even remembered how many shares I had. By then it had peaked and was not looking great. But in 2012 it rose pretty suddenly, maybe because new consoles were announced? We had bought the shares at $11 and in 2012 it rose to 45 or 50, and I remember telling at least one person that I had this cute story about buying a stock with my dad that had finally paid off. But I didn’t really consider selling at all.

Why didn’t you consider selling?

I guess I had a sentimental attachment to it at that point.

Also it was in an account I never checked and for a long time didn’t have access to, so I didn’t really know how.

What’s it been like watching the stock this week?

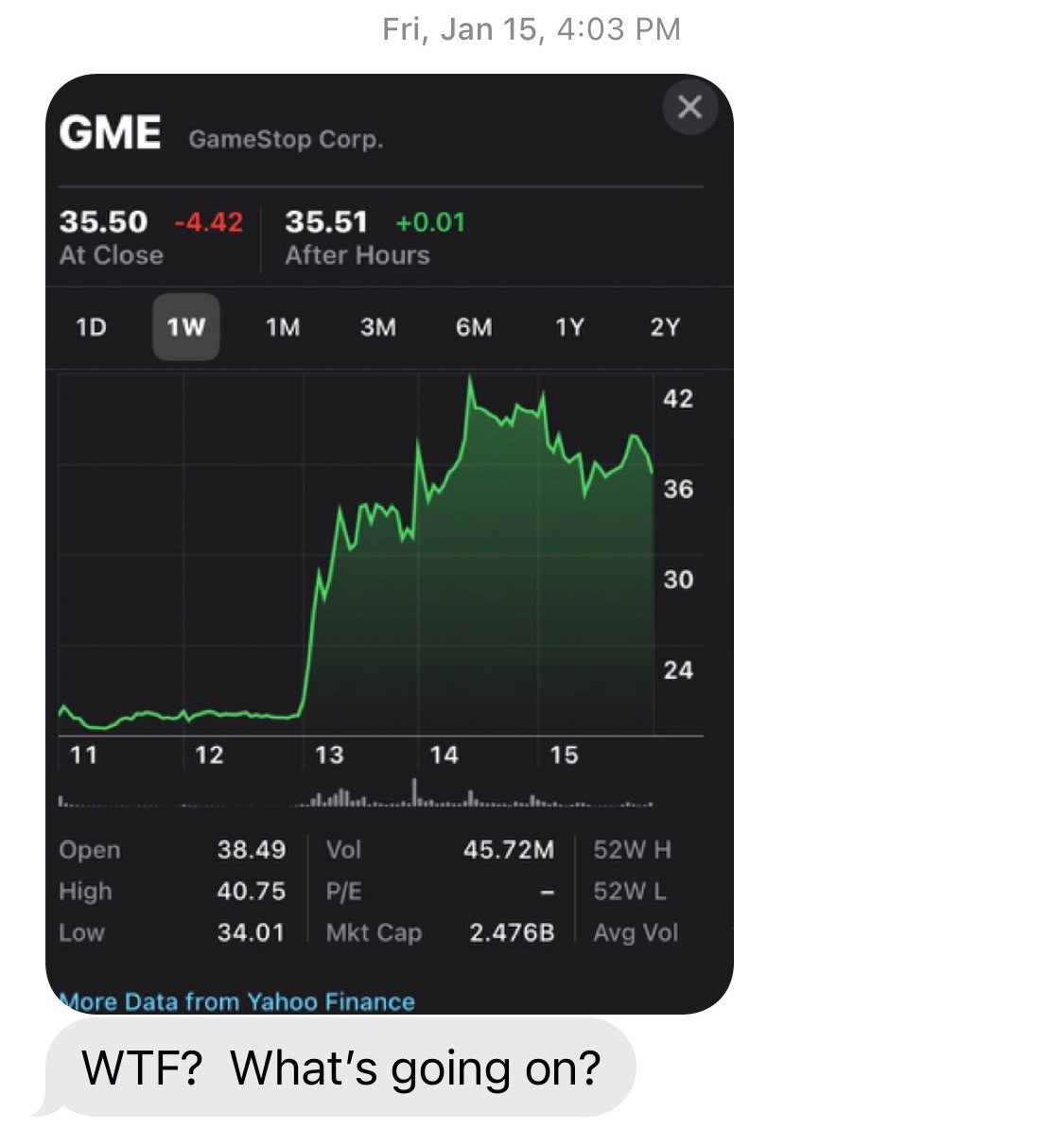

I’m looking back at dad’s texts to get the full timeline. On Aug 31, 2020 he texted me a screenshot from the Apple stocks app showing that GME jumped from about 4.5 to 6.5. I responded ‘Wow’ and promptly forgot all about it. On Sep 25 he sent a screenshot of it jumping to 9.7 with ‘Wow!?’. I said maybe it was related to PS5 preorders. On Oct 8 he sent a screenshot of it at 13.5, and said it was because of a strategic partnership with Microsoft. I think they announced they were gonna sell Game Pass subscriptions or the thing where you pay a monthly fee to get the console.

Then on Jan 15 he sent another update, and it had jumped to 35.5. He said “WTF? What is going on?”. I just googled it and sent him the first result, which was that the Chewy founder had bought a big stake and had a board seat and people were excited about that. “New leadership I guess.”

I think he mentioned it on the phone again that week and on Friday Jan 22 it jumped to 65. Then I started paying attention and found out it had something to do with redditors jacking up the price. I didn’t know anything else besides that, but I assumed it was gonna crash down suddenly. So I quickly learned how to log into that account and sell some shares. I had sold most of my shares by midday Monday, so even though I had an insane return on the 2002 investment I got out way too early. But at the time, I was setting sell limits that seemed extremely high almost as a joke, and then it just kept going up. So for most of the week I’ve only had a few shares left. If I had held for a few more days I could have made a lot more but I also think I would have gone insane. Even just holding these last few shares is pretty stressful.

By the time I started checking wallstreetbets I was already 95% out. Thank god.

Do you have any advice for aspiring investors?

Uh a week ago I would have said “sometimes stores that are crowded are a good investment.” But now I’d probably say 💎🙌🚀 🚀 🚀 🚀 🚀 🚀 you never lose if you don’t sell.

Here’s a “thank you” free space in which you can include any content you’d like that I will be forced to send out to my readers unedited.

I was pretty annoyed when you got an iPod for your bar mitzvah and I didn’t have one yet, but I guess it worked out for me in the end.

here’s my gamestop take, if that matters

There have already been too many pieces about this so unfortunately, I'm gonna go meta and talk about how we talk about this stuff. One could boil this down to The Internet Vs. Wall Street, but that's really not true and does everyone a disservice.

First of all, I am of the mind that you don't defeat a villain by trying to become the villain. I've seen countless posts and image macros and TikToks over the last week comparing insurgent retail investors to Leonardo DiCaprio from The Wolf of Wall Street. I feel like that misses the point -- or rather, it crystallizes the actual, unstated, genuine point of Gamestop short squeezers.

Mainly, however, everyone needs to stop referring to "the internet" as one thing. The online side of this equation has at least three different sects: 1) r/WallStreetBets power users who are, above all else, trying to profit, 2) Robinhood swarmers trying to profit, because the process of buying shares is now virtually frictionless, 3) Robinhood users buying shares almost as a "fuck you" gesture to Big Finance or as a gesture in solidarity with a brand important to highly online games. And I guess you can put "people posting constantly about this because it's pretty funny but not actually executing trades" as a fourth category.

Categories 2 and 3, the Robinhood ones, are effectively shitposters: performing an action not because they care much about the action itself, but because it can be done without any effort or unknown risk. This is where the Elon Musk guys are situated.

I feel like Category 1, however, is in danger of being largely mischaracterized and lumped in with the other two categories as an unfocused, anarchic movement to destabilize the hedge funds, and that largely doesn't track for me. r/WallStreetBets describes itself as "4chan with a Bloomberg Terminal" but I think the contemporary understanding of 4chan differs vastly from the one this description is evoking. The post-2016 4chan has been dominated by racists and Nazis and the terrible politics, and largely unfocused.

4chan doesn't really do coordinated action anymore. To my mind, the 4chan that r/WallStreetBets resembles is more the 4chan circa 2009ish. This is the /b/ that was coordinating attacks on Scientology and putting moot at the top of Time polls. Perhaps the 4chan crowd story I remember most is the one in which they tracked down a woman who threw a cat in a garbage bin after video of it went viral. (The 4chan of 2009 was puerile and unredeemable in myriad ways but there was at least an undercurrent of righteousness beneath the proceedings that has since evaporated.)

The front page of r/WallStreetBets is dominated by shitposts and memes and rallying cries (the associated Discord is largely unhelpful for anyone trying to learn anything as well), but to better understand the subreddit, I recommend looking at a section of it known as "DD," which stands for "due diligence." These posts vary in comprehensiveness, convincingness, and tone, but the best ones harness publicly available info that nobody outside of the finance industry and serious retail investors ever pays attention to. It's tough to shitpost your way through a due diligence assessment. The DD posts read a lot like (how I remember) the crowdsourced research into the cat-bin lady did: blunt, casual, occasionally tasteless, but still, accurate or genuinely striving to be, using info that's not tough to find online if you know where to look (or are really motivated).

Absent the infinite number of motivations caught up in the Gamestop rally (profit, justice, instability, laughs), it's this dynamic that is most interesting to me. The modern internet is one of complacency, letting aggregators and algorithms bring stuff to you, rather than seek it out. It has made the internet worse in many ways. But I tihnk what makes the r/WallStreetBets story so novel is that it’s a lot of people doing research, plumbing data, looking for patterns, in addition to talking shit. Aside from the stuff specific to the finance industry, the Gamestop story is about people on the internet making a deliberate effort to seek out information, rather than waiting for a system to deliver it automatically. It’s the increasingly rare story of people being active in substantial ways — which then kicks off countless, mindless Robinhood transactions.

Elsewhere…

the share thumbnail for this bnet is the nintendo 64 kid. remember that?

"We Spoke to a Guy Who Got His Dick Locked in a Cage by a Hacker”

another entry in the classic online genre of “bad tattoo”

this post shocked me because i honestly forgot what the original looked like

i recommend the entire “dril gamestop” canon

here’s the deal